Published on 1st July 2022

Seed & Establishment

Winter OSR Margins Again Set to Rival Second Wheat in 2023

Winter oilseed rape margins look set to rival those of second wheats once again in 2023 even at decidedly modest yield levels, according to Andersons’ Loam Farm budgets for the coming season.

Winter OSR Margins Again Set to Rival Second Wheat in 2023

Winter oilseed rape margins look set to rival those of second wheats once again in 2023 even at decidedly modest yield levels, according to Andersons’ Loam Farm budgets for the coming season.

One of five business models run by the consultancy using live data from their field team and the latest market intelligence, the 600ha all arable Loam Farm dropped OSR from its ‘virtual cropping’ in 2021 following a disastrous season in 2020.

However, with a 2023 breakeven net margin yield before bonuses of just under 3t/ha at forecast input and harvest prices, agribusiness analyst, James Webster sees the coming season as a good time to seriously consider bringing the crop back into the rotation.

“We don’t foresee winter OSR margins for the year ahead matching the modern day record we anticipate for the current season at our conservative 3.3t/ha average yield,” he explained at a special Dekalb crop outlook briefing.

“But, at an ex-farm rapeseed value of £575/t excluding bonuses and realistic input price expectations, our 2023 Loam Farm budgets show a very reasonable net margin after all costs of £185/ha from oilseed rape. This is well above the £119/ha we are forecasting for a 4.5t/ha crop of spring beans, on a par with a 7.7t/ha Loam Farm crop of spring feed barley and close to our £203/ha expectation for an 8.3t/ha second milling wheat (Table).

Table: Andersons Loam Farm budgets 2022/2023

Key variable cost assumptions – Nitrogen £675/t; Potash & phosphate £750/t; diesel 105p/litreFixed costs include labour & power; overheads; and rent & finance

“At these costs and values, our break-even net margin yield is 2.98 t/ha. And even if harvest 2023 rapeseed values drop to the £500/t we can’t realistically see them falling below given current market fundamentals, the break-even yield is very reasonable 3.43t/ha.”

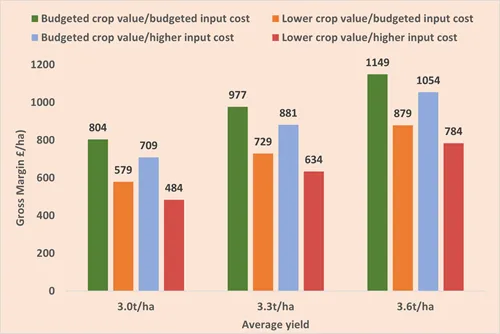

Anderson’s sensitivity analyses show gross margins before bonuses ranging from just over £800/ha at a yield of 3.0t/ha to almost £1150/ha at 3.6t/ha at budgeted OSR costs and values.

Budgeted crop values with nitrogen at £750/t, diesel at 120p/litre and seed at £104/ha rather than the currently budgeted £99 give margins varying from around £710/ha to just over £1050. And a worst-case scenario of lower crop values and higher costs mean gross margins from £480/ha to £780/ha, depending on yield (Figure).

Figure 1: Andersons Loam Farm gross margin sensitivity – 2022/23

Crop values – Budgeted = £575/t; Low = £500/t Input costs – Budgeted = £921/ha; High = £1016/ha

“Our budgets look particularly encouraging for growers that can average 3.3t/ha or more even with a less good season that we’ve just enjoyed,” Mr Webster pointed out.

“We see £575/t ex-farm before bonuses as a realistic expectation for next harvest. “But even at £500/t, OSR would seem to stack-up well for those who have reined back substantially, if not completely, on the crop in recent years. Especially if the crop is now only being grown once in every five or six years in the rotation with beans or oats as alternative wheat breaks.

“Despite all the problems the crop has given many in recent years, it is currently looking noticeably less risky than it has been and shaping-up to be the best cereals break you can get once again.

“Providing there is sufficient moisture for another good establishment season. we see the current UK area brought to harvest increasing to around 450,000 ha in 2023. While much will depend on the volume carried through to harvest, this is a very welcome turnaround indeed.”